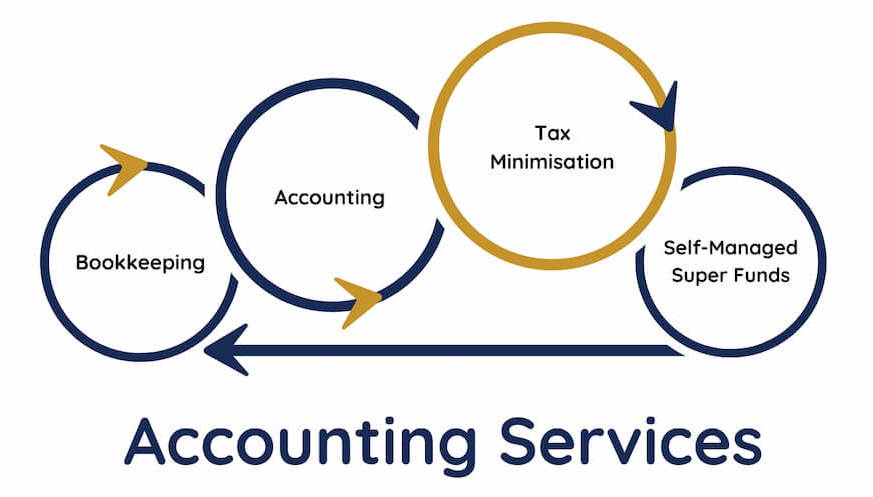

Accounting services

customised to your needs

Compliance for Confidence

Doing things differently

Traditionally bookkeeping, tax returns, preparing BAS/IAS and financial statements each year, were the only services that accountants provided.

While we believe knowing your numbers is critically important to business success, we use those compliance-based services as useful financial data-points to inform our business advisory services.

Helping you move forward with confidence.

Cloud-based accounting specialists

Cloud-based accounting software helps you manage the reporting and compliance obligations of your business while offering a real-time financial management snapshot.

We are a Xero Partner who will support you to get the most out of your software.

Taking the stress out of tax

Preparing and lodging your tax returns on time, AND liaising with the ATO on your behalf.

We can handle payment arrangements, request remission of penalties and apply for extensions (if required), leaving you to focus your energy on other areas of your business.

Specialising in

-

Tax Minimisation

-

Income Tax

-

Capital Gains Tax

-

Payroll Tax

-

Fringe Benefits Tax

-

BAS & GST

-

Small business tax concessions

Bookkeeping that suits you

We can provide you with your own dedicated bookkeeper who can help you record your day-to-day transactions and reconciliations, track your sales and manage your payables and payroll.

5 simple steps:

1

You upload receipts easily via phone or email.

2

We enter all the receipts, bills & invoices and reconcile the transactions.

3

We ensure all your systems are integrated.

4

We provide you with custom reports, highlighting the performance of your business.

5

You can track your progress to improve results.

Sign up for a free consultation!